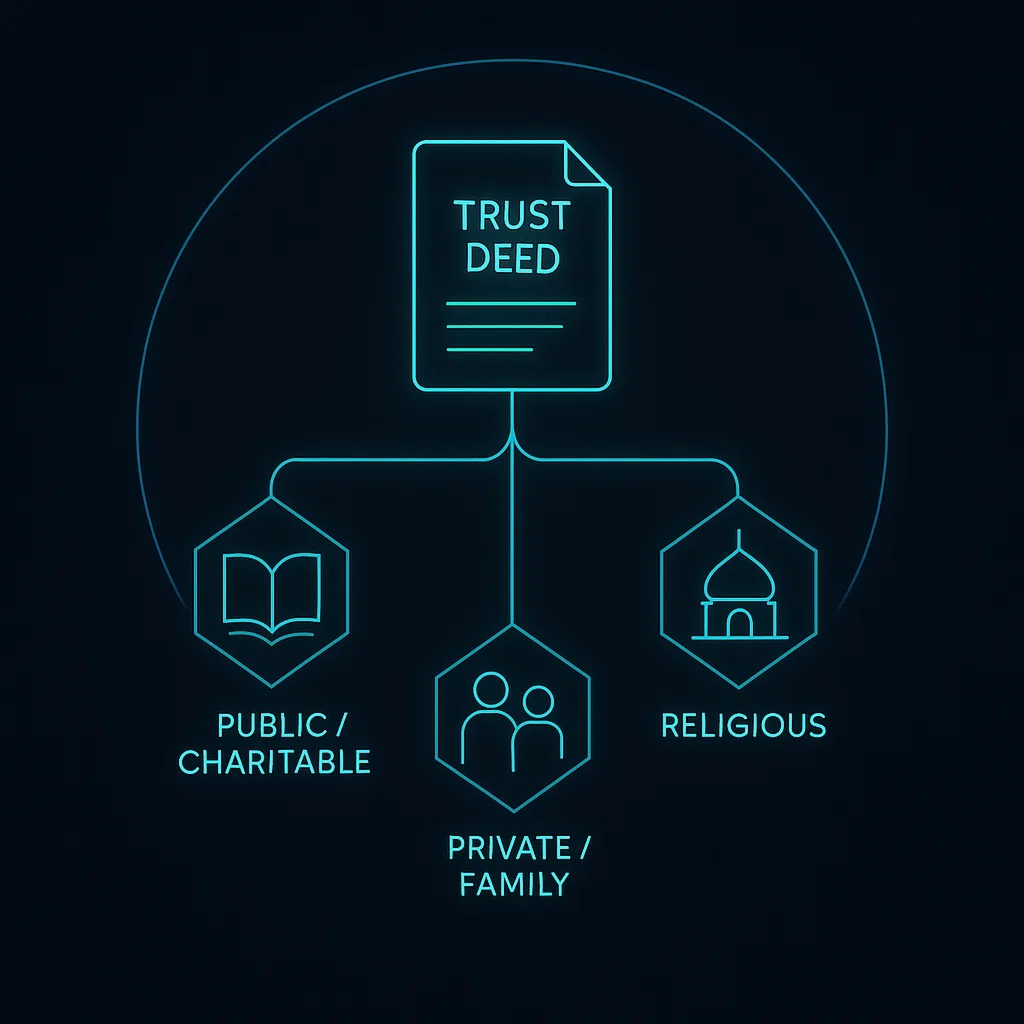

Types of Trusts We Advise On

1. Public Charitable Trusts

Formed for public benefit — education, healthcare, poverty relief, or cultural promotion.

Examples: Educational trusts, hospitals, welfare institutions.

Governed by: Charitable and Religious Trusts Act, 1920, and state endowment laws.

2. Private and Family Trusts

Created for the benefit of identified persons or family members.

Governed by: Indian Trusts Act, 1882.

Examples: Family wealth management, property protection, inheritance planning.

3. Religious Trusts

Established for managing temples, maths, or religious endowments.

Governed by: Religious Endowments Act, 1863, and Karnataka HRCE Act, 1997.

4. Corporate and Institutional Trusts

Created by companies or NGOs for CSR and social welfare initiatives.

Governed by: Charitable Endowments Act, 1890 & Companies Act, 2013.

Our Core Legal Services

1. Trust Formation & Registration

Drafting and vetting of Trust Deeds and governing documents.

Assistance in determining trust type and structure (public, private, religious).

Registration with Sub-Registrar of Assurances under the Registration Act, 1908.

Support in obtaining PAN, 12A, and 80G registration for income tax benefits.

Representation before Charity Commissioner and Endowment Department.

2. Compliance & Legal Governance

Maintenance of statutory registers, minutes, and annual audit reports.

Filing of annual returns and income tax compliances.

Advisory on FCRA registration, CSR funding, and foreign donations.

Legal due diligence and internal compliance audits.

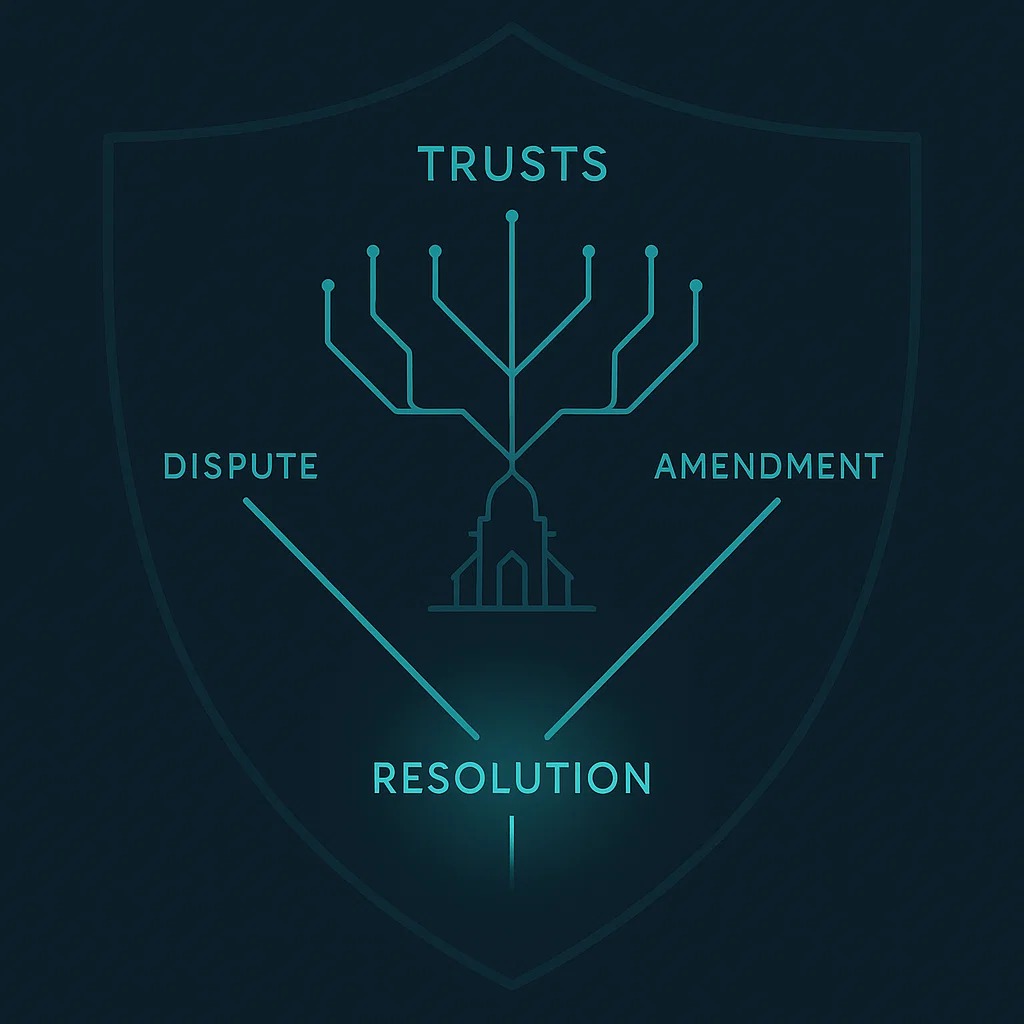

3. Amendment & Reconstitution

Change of trustees, registered office, or objectives.

Amendment or restatement of trust deeds.

Succession planning and property transfer advisory.

4. Property & Asset Management

Legal due diligence for trust-owned land and properties.

Drafting of lease, gift, and donation deeds.

Mutation, title verification, and litigation on encroachments or misuse.

5. Litigation & Dispute Resolution

Representation before Civil Courts, Charity Commissioners, and High Court of Karnataka.

Disputes relating to trustee misconduct, management control, or misuse of funds.

Filing and defense of suits under Section 92 of the CPC for charitable and religious trusts.

6. Religious & Temple Endowment Services

Registration and compliance under Karnataka HRCE Act, 1997.

Advisory on temple governance, hereditary trusteeship, and donations.

Representation before Commissioner for Hindu Religious Institutions and Charitable Endowments.

7. Income Tax & Regulatory Advisory

Registration and renewal of exemptions under Sections 12A & 80G.

Tax planning and representation before Income Tax Authorities.

Guidance on FCRA and CSR partnerships for charitable trusts.